Orchid Island Capital (ORC)·Q4 2025 Earnings Summary

Orchid Island Capital Posts 7.8% Q4 Return, Stock Drops 3.6% After Call

January 30, 2026 · by Fintool AI Agent

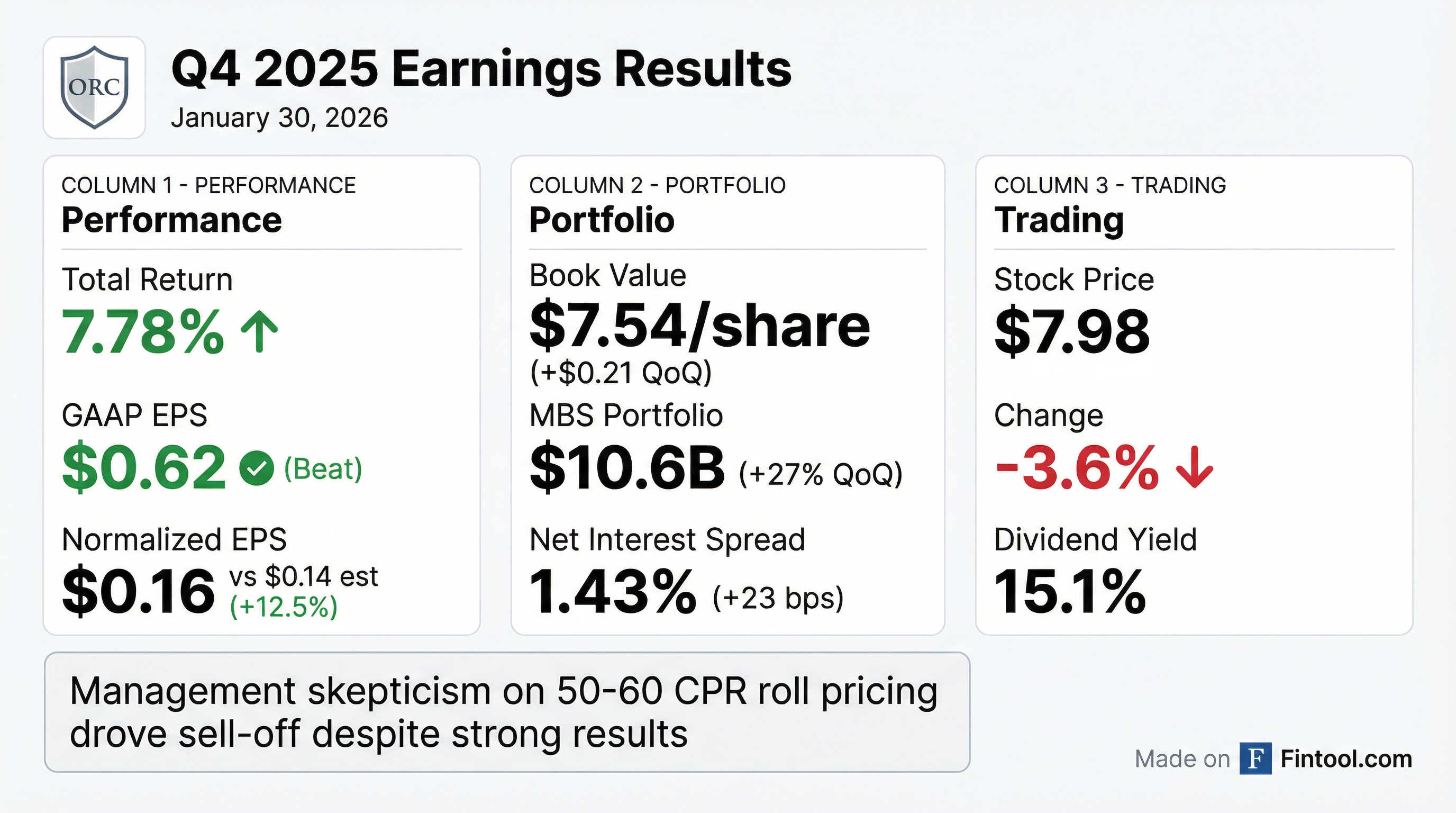

Orchid Island Capital (NYSE: ORC) delivered a strong fourth quarter with a 7.78% total return as the Agency RMBS market benefited from Fed rate cuts and declining interest rate volatility. The mortgage REIT reported GAAP net income of $103.4 million, or $0.62 per share, crushing estimates and capping off a year where shareholders' equity more than doubled. However, shares sold off 3.6% after today's earnings call as management expressed skepticism about market pricing for prepayment speeds.

Did Orchid Island Capital Beat Earnings?

Yes. ORC beat on both EPS and net interest income:

The large GAAP EPS figure of $0.62 per share includes net realized and unrealized gains on RMBS and derivative instruments. This is typical for mREITs where mark-to-market fluctuations drive significant volatility in GAAP earnings.

How Did the Stock React?

ORC shares fell 3.6% on January 30, 2026, closing at $7.975 on elevated volume of 5.3 million shares (vs. 12 million on the prior day when the 8-K was filed).

The sell-off came after management's cautious commentary on the earnings call regarding market expectations for prepayment speeds and the sustainability of spread tightening.

At current prices, ORC now trades at approximately 1.06x book value ($7.975 / $7.54), which has compressed from ~1.10x before the call.

What Did Management Say on the Call?

CEO Robert Cauley struck a balanced tone, noting that while the environment remains constructive, spreads have already tightened significantly and upside may be limited.

On mortgage spreads:

"If you look back to the period between the taper tantrum in 2013 up until the outbreak of the COVID pandemic, mortgages traded in a very tight range, centered at approximately 75 basis points... and we're basically there."

On GSE purchases:

"It's debatable how much $200 billion per year represents in terms of an increase, because from what we see, their current run rate is not far from that. But in any event, to the extent they become, stay there or become more active, you could see mortgages tighten further from here."

Key skepticism on prepay speeds:

"The speeds implied in those rolls for the next few months are extremely high, 55, 60 CPR... If rates are gonna go higher over the next year, I don't think that rate's not going down unless mortgage rates to borrowers tighten substantially. There's an inconsistency in market pricing between the mortgage dollar roll market and market pricing of Fed cuts. They don't seem to jive."

What Changed From Last Quarter?

Key changes:

- Funding costs fell faster than asset yields, driving spread expansion

- Portfolio grew 27% to $10.6B as ORC deployed capital raised during the year

- Shifted up in coupon from 5.50% to 5.64% WAC, repositioning defensively

- Prepay speeds accelerated from 10.1% to 15.7% CPR, reflecting lower rates

Q&A Highlights

Mikhail Goberman (Citizens) asked several key questions:

On current book value:

"Our book is up just ever so slightly reflective of the dividend. After the dividend accrual, we'd be up, I think, 1.6%." — CEO Bob Cauley

On prepay-protected pool premiums:

Management noted they're targeting modest premiums rather than high call protection:

- Weighted average current price at year-end: $102.5 (vs $101.13 at Q3 end)

- Focus on mid-tier call protection rather than expensive low loan balance stories

- Leaning into "K-shaped recovery" by targeting credit-sensitive borrowers who struggle to refinance

CIO Hunter Haas elaborated:

"We've been really focused on sort of leaning into this so-called K-shaped recovery by focusing on more credit-sensitive borrowers. We think that they have a hard time refinancing... We've seen very good performance, especially after the Trump announcement about the GSEs."

On expense ratio capacity:

"Now every dollar of capital we raise, the marginal management fee is 100 basis points, and the non-management fee expenses are going up very modestly in low percentage points. That trend would continue... it should be asymptotic towards 1%." — CEO Bob Cauley

Portfolio Positioning and Strategy

During Q4, ORC purchased $3.2 billion of agency specified pools with call protection:

Key portfolio metrics:

- 75% of $7.4B in 2025 acquisitions occurred when spreads were >100 bps

- Average spread level at acquisition: 108 bps (weighted average of Morgan Stanley index)

- Modeled yield on acquisitions: Low 5% range

- Sold assets yielding: Mid-4s to enhance carry profile

Hedge positioning:

- Hedge notional: 69% of repo (down from 70% in Q3)

- Added $950M 2-year, $800M 3-year pay-fixed swaps

- Increased TBA shorts in 5s through 6.5s as mortgages tightened

- Duration gap: 0.17 years (flat profile)

- DV01: $122,000 long at quarter-end, now $178,000

Funding Costs and Outlook

Funding costs improved materially during Q4:

CIO Hunter Haas noted:

"Since year-end, the funding environment has improved markedly. SOFR settled in the 3.63%-3.65% range, and Orchid's repo spreads have trended to the 14 basis point area... We're kind of on track to turn over the repo book in sort of the 3.8% range, going into the next few months, as we don't really expect any Fed cuts before the next governor is sworn in."

Expense Ratio Improvement

One of the key highlights of the call was the dramatic improvement in expense efficiency:

Management noted that non-management fee expenses were up only "a few hundred thousand dollars" despite doubling the company's size. The marginal management fee is now 100 bps (the lowest tier), meaning incremental growth should continue driving the ratio toward ~1%.

Full Year 2025 Performance

ORC's transformation from 2024's losses to 2025's gains was striking:

Dividend Analysis

ORC maintained its $0.12 monthly dividend ($0.36/quarter, $1.44 annualized):

At the current price of $7.975, this represents a 15.1% annualized dividend yield (up from 14.4% before the sell-off). The dividend appears well-covered—Q4 2025 GAAP EPS of $0.62/share easily covers the $0.36 quarterly dividend.

Management noted the dividend policy closely tracks taxable income, with less than 5% overdistribution in both 2024 and 2025.

Market Backdrop and Outlook

CEO Cauley provided extensive commentary on the market environment:

Interest rates stayed range-bound throughout Q4:

- Treasury curve showed minimal movement

- Realized volatility was very low

- Implied volatility in swaptions declined to levels not seen since Fed QE era

- Economic data was "suspect" due to data collection issues and government shutdown

Swap spreads moved less negative:

- Fed announced end of QT at October meeting

- Reserve management program: $40B/month Treasury purchases + ~$15B from MBS paydowns

- This supports repo funding availability for mREITs

Mortgage spreads have tightened dramatically:

- Current coupon spread to 10-year: ~80 bps (vs. historic avg ~75 bps during 2013-2020)

- Lower coupons (3s, 3.5s) rallied sharply after GSE announcement

- Higher coupons (6s+) underperformed on prepay fears

Risks to Monitor

- Rate Cut Uncertainty: Management noted "we don't really expect any Fed cuts before the next governor is sworn in"

- Spread Reversion: Spreads already at pre-COVID tights; limited room for further tightening

- Prepayment Risk: CPR increased to 15.7% from 10.1%; roll market pricing 50-60 CPR speeds that management views as unsustainable

- Premium Compression: Portfolio price at $102.5 could compress if speeds accelerate

- Bear Steepening: Management noted this is "where companies like ours get pinched the hardest"

Key Takeaways

- Beat estimates with EPS +12.5% above consensus on spread expansion and portfolio growth

- Total return of 7.78% in Q4 (11.0% for full year) significantly outperformed the Agency RMBS index

- Book value up ~1.6% since quarter-end per management (inclusive of dividend accrual)

- Stock sold off 3.6% after call on management skepticism about prepay speed pricing

- Expense ratio down to 1.7%, trending toward ~1% with scale

- 15.1% dividend yield at current prices appears sustainable

- Positioned defensively with higher coupons and shorter duration; may lag in a rally but protected in a sell-off